Post- shipment Finance

An organization provides post-shipment finance to meet working capital requirements after the actual shipment of goods. It bridges the financial gap between the date of shipment and the actual receipt of payment from overseas buyers thereof.

WHO IS THIS FOR?

A firm that is looking for working capital to fill the gap of the duration between his shipped goods and the payment received for them

HOW DO I SIGN UP?

Your business/financial analysis report, financial model, valuation, pitch book, or Information Memorandum will be compiled

NDA and mandate are signed on agreed terms after target companies/investors are reached out using a tailor made methodology.

KEY BENEFITS

Reduced working capital cycle for the firm

Firms can convert their credit sale into cash sales, hence freeing up their capital for further exports

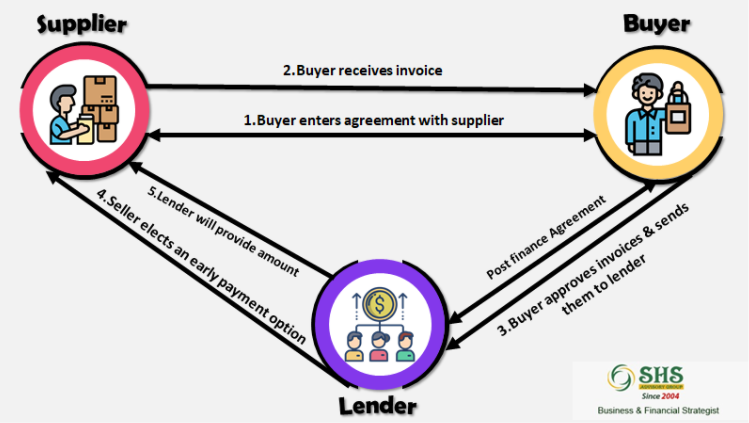

OUR PROCESS

Post shipment loans help firms to get finance without waiting for sales from their overseas buyers

Here at SHS Advisory group, we practice different strategies to connect with potential financiers. We will set up a meeting with you to understand your requirement. We will analyse your statements and convey the same to the financiers. Terms and conditions will be discussed at the time the deal is placed