Accounts and Regulatory services are essential for every company/ proprietorship. This service is highly effective, low priced, and beneficial to track the company status and regulatory update every month.

WHO IS THIS FOR?

This service is available for all firms, companies, LLP, Proprietorship, and all types of businesses

HOW DO I SIGN UP?

Post the detailed discussion you will be sent the list of items required. The details will be analysed and the guidelines for the process will be provided. Complete support is provided by hosting weekly discussions and Monthly reporting.

KEY BENEFITS

Promoter can easily analyse and track the financials monthly without undergoing any pressure.

Instead of yearly analysis/yearly updating to regulatory, the monthly analysis/regulatory update would give you an update on the performance track.

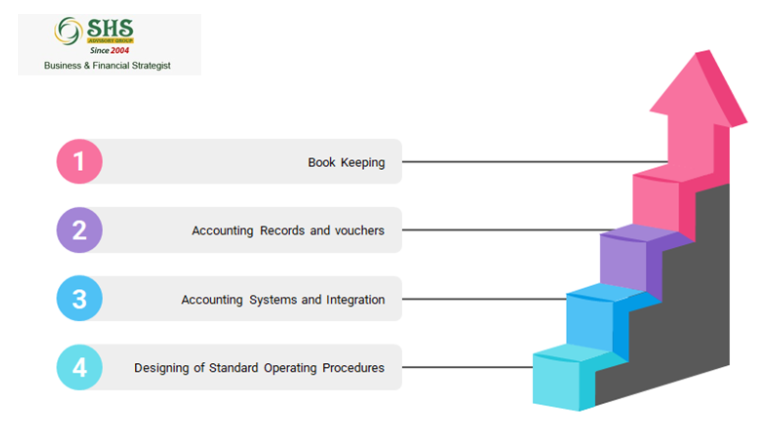

OUR PROCESS

One person will be deputed at the client’s place throughout the month. Wherever possible an off-site work can be done by a team of professionals. This package is designed for monthly and annual filing and compliance, where we prepare the books of accounts, regularly during the year.

LIST OF THINGS WE MAINTAIN/UPDATE

We maintain books of Accounts and involve in the Bookkeeping process. We prepare, review, correct, to achieve the following objective:

Accounting Books: Accounting Entries are done as per the legally prescribed methods, internal reporting requirement, and initiating necessary actions, wherever required.

Review of Employee ledgers, Supplier Ledgers, Customer Ledgers, Director Ledgers,

Fixed Assets Ledger, security deposits to identify and initiate actions

A. Accounting Records and vouchers are in a proper manner:

Payment Voucher

Receipt Voucher

Journal Voucher

Bank reconciliation and statements

Copies of all invoices (Sales and Purchases)

Taxation records are kept properly by the finance department

B. Other Monthly/Annual Compliance:

Monthly and Annual GST Returns

Regular TDS Returns – Non-Salaries

Regular TDS Returns – Salaries

Assistance in depositing GST, TDS, and Advance Tax

Advisory at current level/activities

C. MCA Compliance:

Minutes of Board meetings

Directors’ Interest disclosure

Directors’ disqualification disclosure

Directors’ Report

Conducting Annual General Meeting

KYC of directors – Form DIR-3 KYC

Return of Deposits – Form DPT-3

Annual Return – Form MGT-7

Appointment of Auditors – Form ADT-1

Filing of Financials – Form AOC-4

AOC-2

MGT-9