Amalgamation happens when two or more organizations/corporation combine into one new entity. Since the new entity formed is entirely different legally from the pre-amalgamation entities, it is non-identical to mergers.

WHO IS THIS FOR?

Existing companies looking to enter a new market.

Companies trying to launch a new product.

Companies trying to cut the operating cost of the business.

Companies looking for new technologies

Companies looking to increase the customer base.

HOW DO I SIGN UP?

Your business/financial analysis report, financial model, valuation, pitch book, or Information Memorandum will be compiled

NDA and mandate are signed on agreed terms after target companies/investors are reached out using a tailor made methodology.

KEY BENEFITS

Elimination of competition in the market

Reduction in the operating costs to an extent

Managerial effectiveness

Helps to face competition

Tax advantages

Increase in market share

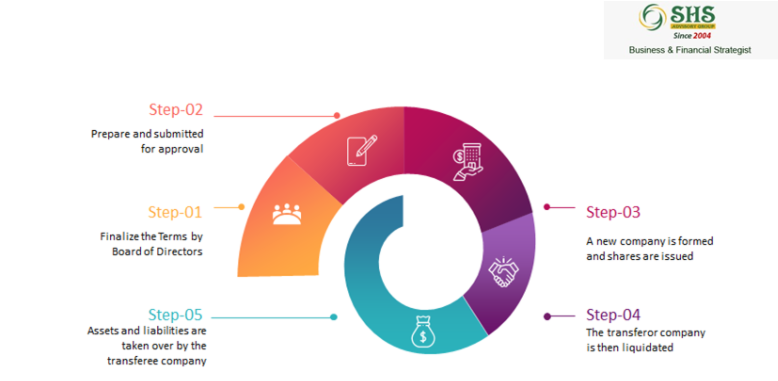

OUR PROCESS

When a company enters Amalgamation, its primary motive is to expand its business operations. Here at SHS Advisory group, we practice different strategies to connect with potential companies. Our large customer base is important to deeply research and use the upstream and downstream analysis approach to find new companies in the market.

The list of actions that we follow are mentioned below:

Scrutinize Information memorandum or pitchbook

Create one-page marketing information to be sent to the companies but excluding the name.

Conduct a meeting with our team to brainstorm ideas in order to fix the target companies sector, selection criteria, size, territory, Methods of approaching and reaching out to them, etc.

(a) Method 1: Identity platforms to get investor networking (eg: BIZIT, banker burry, SMERGER). Then by paying a certain amount, we list our client requirements on these platforms, and we continue with the process which is time consuming. The success rates are unpredictable and our credibility with the investors is important for us

(b) Method 2: The target company’s contact details can be collected by conducting intensive and detailed research and networking. We then pay and use various platforms (eg: rocket reach) to get contact details

After the selection process, we give our first pitch through call or email.

Our investment banking associate will discuss in detail with the investor and will arrange a meeting with our management to explain the structure, our reasons to invest, methods, deal size, etc

Further meetings are arranged with the client along with you either virtually or face to face.

Our associate explains the investment details to the target

Our valuation and evaluation

Discussion on the terms, negotiate if need be, and final closure

Finally, implementation.