Delisting involves removal of listed securities of a company from a stock exchange where it is traded on a permanent basis.

WHO IS THIS FOR?

A company that wants to go private in order to increase its authority.

HOW DO I SIGN UP?

Your business/financial analysis report, financial model, valuation, pitch book, or Information Memorandum will be compiled

NDA and mandate are signed on agreed terms after target companies/investors are reached out using a tailor made methodology.

KEY BENEFITS

Companies that are below their average industry profitability enjoy better share price appreciation after purchasing shares than companies with profitability above their industry average.

Companies whose sales growth was below their industry average had a higher share price rise after the repurchase of shares than those whose sales growth was above their industry average.

Rentable and development businesses that repurchase shares are a direct indicator to investors of the company’s strengths.

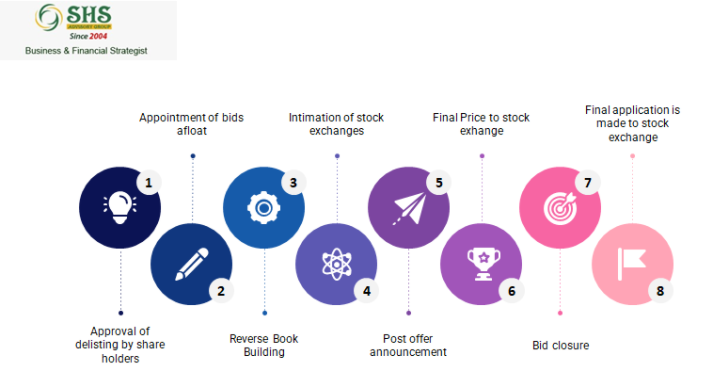

OUR PROCESS

FACTS ON DELISTING

A listed company’s shares get delisted voluntarily from the exchange for various reasons such as mergers and acquisitions or the need to go private etc.

A company gets delisted involuntarily because of reasons like filing bankruptcy, failure to comply with exchange regulatory requirements, non-compliance with the listing guidelines, late filing of reports, and low share price and so on.