A branch office is suitable to establish a temporary presence in Indian cities. The branch office serves as an extension of the head office business and carries on the same business and activity as that of its parent company

Procedure for a Foreign company to set up a Branch Office in India

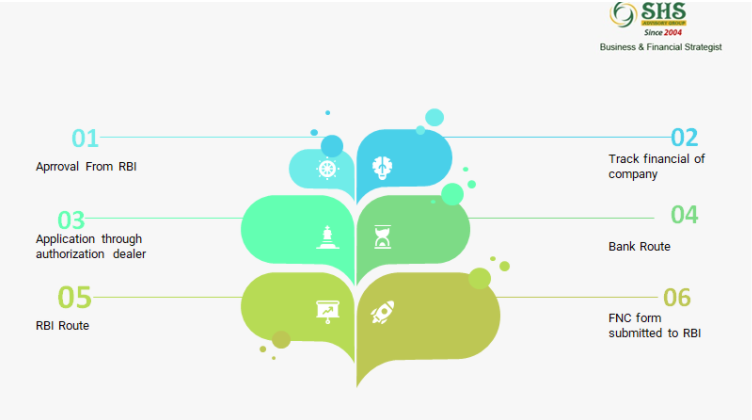

Foreign companies can set up a branch office in India. But unlike the case of setting up a company, a branch office requires approval from the Reserve Bank of India (RBI). Only upon getting the branch license from RBI, the foreign company can commence the operations.

A branch office is suitable for a foreign company to test and understand the Indian market as it does allow the companies to just do the major activity. Any additional activity to be carried by the Branch office shall be illegal.

Approval from RBI for setting up branch offices is granted by the Foreign Exchange Department, Reserve Bank of India, Central Office in Mumbai.

Reserve Bank of India considers the track record of the applicant company, the activity of the company proposing to set up an office in India as well as the financial position of the company while scrutinizing the application.

The applications from such entities in Form FNC (Annex-1) will be considered by the Reserve Bank under two routes:

- Reserve Bank Route — Principal business of the foreign entity falls under sectors where 100% Foreign Direct Investment (FDI) is permissible under the automatic route.

- Government Route — Principal business of the foreign entity falls under the sectors where 100% FDI is not permissible under the automatic route.

- Applications from entities falling under this category and those from NGOs / Non – Profit Organizations / Government Bodies / Departments are considered by the Reserve Bank in consultation with the Ministry of Finance, Government of India.

The application in the prescribed form should be submitted to the RBI through the Authorized Dealer bank.

Procedure for Approval from RBI

Currently as per the RBI Requirement, the application for the branch office and branch office is submitted through the Authorized dealer. The authorized dealers are the institutions having banking licenses.

The application in the prescribed form (Form FNC) should be submitted to the RBI.

Required Documents

FNC form duly signed by AR

Information about the parent company along with its certificate of incorporation attested by a Notary Public or the Indian Embassy in the country of registration

The incorporation documents of the branch office to be established in India

Proof of registered office

A note on location or proposed activity

The latest audited balance sheet of the applicant entity

Board resolution to open a branch office

KYC of the authorized signatory

Information about the local representatives of the parent company in the branch office