Global Depository Receipts

Global Depository Receipts are securities certificates issued by intermediaries such as banks for facilitating investments in foreign companies. A GDR represents a certain number of shares in a foreign company that is not traded on the local stock exchange.

WHO IS THIS FOR?

Shares can reach a broader and more diverse audience of potential investors, and with shares listed on major global exchanges.

Increases the status or legitimacy of an otherwise unknown foreign company.

HOW DO I SIGN UP?

Your business/financial analysis report, financial model, valuation, pitch book, or Information Memorandum will be compiled

NDA and mandate are signed on agreed terms after target companies/investors are reached out using a tailor made methodology.

OUR PROCESS

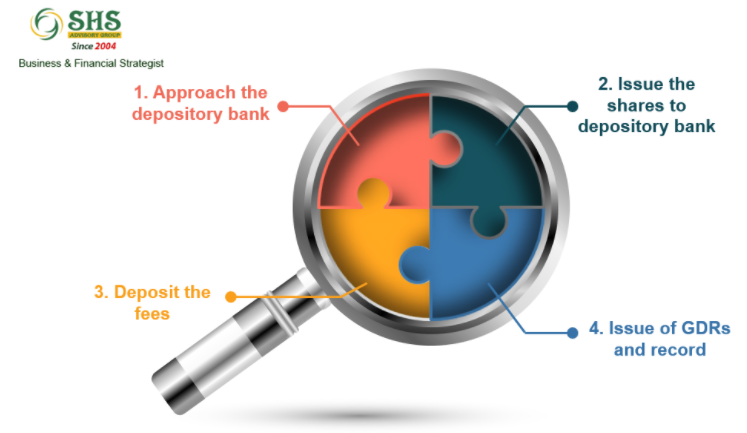

The procedure of issuing GDRs by an Indian company involves

Issuing of its equity shares (in rupees) to the depository bank situated in a foreign country

The issue of GDRs by the depository bank against the said equity shares to the foreign investors in foreign currency

Deposit the fees

Issue of GDRs and Record