Mainboard IPO

IPO is the process by which the privately-owned company initially sells its shares to the public for the purpose of getting listed on BSE & NSE stock exchanges.

Only companies with a minimum post-issue paid-up capital of Rs.10 crores can raise funds and thus get listed via Mainboard IPO.

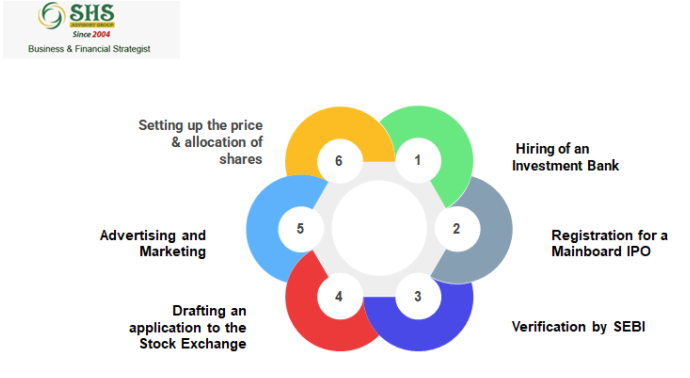

OUR PROCESS

The hiring of an Underwriter or Investment Bank

Registration for a Mainboard IPO

Verification by SEBI

Drafting an application to the Stock Exchange

Advertising and Marketing the IPO across the country

Setting up the pricing for the IPO

Allotment of Shares

Required Documents

Certified copy of Memorandum & Article of Association

Prospectus & agreement with underwriters

Details of Capital Structure

Copies of an advertisement offering securities during the last 5 years

Copies of financial statement & auditor’s report for the last 5 years

Copy of shares & debentures, letter of allotment, and letter of regret

Details of the company since incorporation including changes in the capital structure, borrowings

Details of shares or debentures issued for consideration other than cash

A statement defining the distribution of shares and other details related to the commission, brokerage, discounts, or terms related to the issue of shares

Agreement with a financial institution, if any

Details of shares forfeited

Details of securities about which permission to deal with are applied for

A copy of consent from SEBI