A pitchbook is a detailed, data-rich document that describes a company’s business, provides historical financial information and projections, details on assets, and offers a summary of a preferred transaction structure and steps.

WHO IS THIS FOR?

This service is provided to all startup companies

HOW DO I SIGN UP?

Post the detailed discussion, we will submit the report in 5 days. Your Financial projections, financial models, valuation, type of pitchbook required, business type will be gathered in the initial meeting. An attractive animation or video presentation based on your budget is submitted in 7days followed by the pros and cons of PB

KEY BENEFITS

You will receive about 20 Slides or more/40 Seconds video presentation and more. This is a guide to present the market overview, valuation, and transaction strategy to persuade the potential client or investors to decide either to use the services or products or investment decisions.

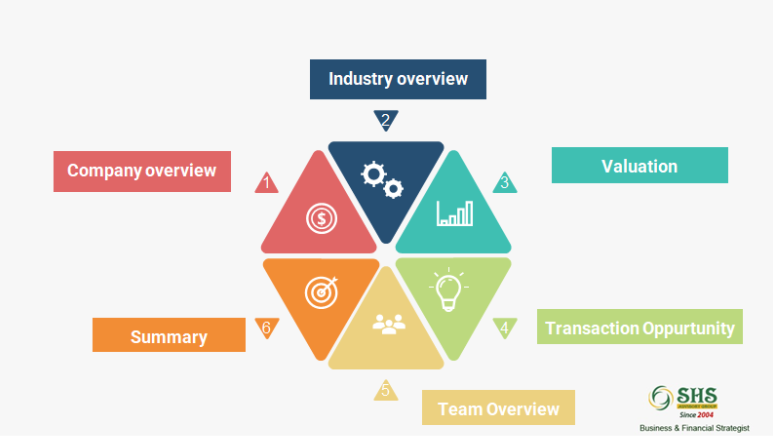

Slide contents

Title page – Logos, Date, and a Title

Table of Contents – All sections in the pitch book

Executive Summary / Situation Overview – Explain why you’re giving the pitch and the call to action or recommendation in one page

Team & Bank Introduction – Introduce the people at the meeting (short biographies) and discuss the bank’s track record in the client’s space

Market Overview – Charts and graphs, as well as commentary describing the current market environment and trends in the client’s sector

Valuation – Valuation methods include comparable company analysis, precedent transactions, and DCF analysis (if enough information has been provided to perform one) all displayed in a football field graph

Transaction Strategy – Details around the bank’s strategy for the transaction they’re pitching the client to lead – whether an IPO, acquisition, or sale of the business

Summary – Recap why the team and the bank are best suited to lead the transaction, how the market environment is relevant, the valuation you think is achievable, and the band’s strategy if leading the transaction

Appendix – May contain a wide range of information depending on the pitch, but mostly backup information the bank feels there may be questioned on, but doesn’t belong in the main pitch book – like financial modelling assumptions/details