SME IPO

Small and Medium Enterprises (SME) IPO is a way for a private small company to sell its shares to the public for the first time and get listed at BSE SME or NSE Emerge platform.

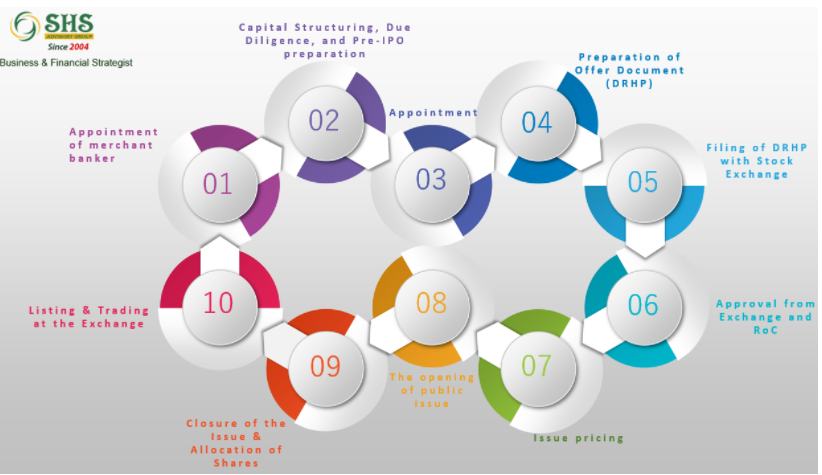

OUR PROCESS

Appointment of Merchant Banker

Capital Structuring, Due Diligence, and Pre-IPO preparation

Appointment of Bankers, Registrar, Market Makers, RTA, etc.

Preparation of Offer Document (DRHP)

Filing of DRHP with Stock Exchange

Approval from Exchange and RoC

Issue Pricing

The Opening of Public Issue

Closure of the Issue & Allocation of Shares

Listing & Trading at the Exchange

Documents required- Estimated items

Draft offer document

Copy of the Prospectus

Copy of resolution passed by the Board of Directors

Copy of the shareholders’ resolution passed under 62(1)(c) of Companies Act, 2013

Certificate from either the Managing Director / Company Secretary or PCS / Statutory or Independent Auditors

Copy of all show cause notice/orders issued

PAN & TAN of the Company

DIN & PAN of Promoters and Directors

Balance Sheets, P&L Statements, and Cash Flow Statements for the last 5 years (or for such applicable periods)

Copies of major orders or contracts

Details of the present or any previous application of the Company/Group Company for the listing of any securities have been rejected earlier by SEBI or by any stock exchange and reasons also

Name of the exchange which is proposed to be designated Exchange for the issue

Copies of agreements and memoranda of understanding between the Company and its promoters/ directors

Articles & Memorandum of Association of the Company

A certificate issued by the statutory auditor/practicing chartered accountant

Association, if any, of the directors/ promoters of the Company with any public or rights issue made during the last 10 years

MAJOR PARTICIPANTS

Company Promoters

SME IPO Assistants

Registrar of Companies (RoC)

Merchant Banker or Investment Banker

Bankers

Registrar and Transfer Agents (RTA)

Market Maker

Depositories (CDLS, NSDL)

Stock Exchanges (BSE or NSE)

Auditors

FACTS ON SME IPO

Companies with minimum post-issue capital of Rs 1 crore and a maximum of Rs 25 crores are eligible for SME IPO in India

BSE SME and NSE Emerge platforms allow SME companies to raise funds and get listed at the exchange through an SME IPO