Advance Payment Guarantee

An advance payment guarantee is used when the contract provides for advance payment to be made to the seller, and it guarantees that the advance payment will be returned to the buyer if the seller does not fulfill its obligations on delivery of goods or services

WHO IS THIS FOR?

Companies looking for funding against bill, supplier, guarantee or short term funding

HOW DO I SIGN UP?

Your business/financial analysis report, financial model, valuation, pitch book, or Information Memorandum will be compiled

NDA and mandate are signed on agreed terms after target companies/investors are reached out using a tailor made methodology.

FACTS ON ADVANCE PAYMENT GURANTEE

It is a contract under which the issuer is responsible for the fulfillment of a contractual obligation owed by one person to another if the first-person is default. The issuer’s obligation may be primary (as in an on-demand obligation or indemnity) or secondary (as in a guarantee).

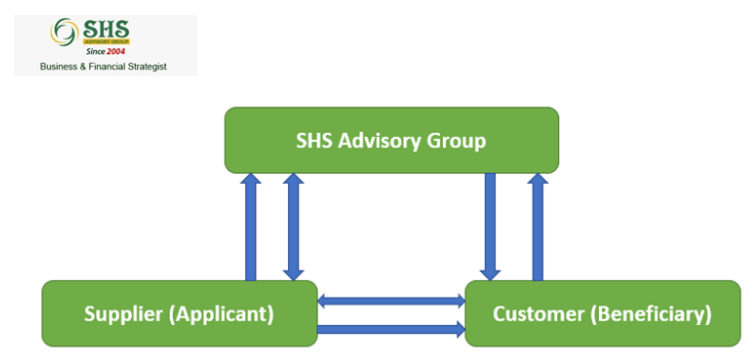

An advance payment guarantee or bond is typically used to underpin or guarantee the performance of a commercial contract, such as a contract for the sale of goods (where the buyer is the beneficiary) or a construction contract (where the employer is the beneficiary)

A payment guarantee assures a seller the purchase price is paid on a set date. An advance payment guarantee acts as collateral for reimbursing advance payment from the buyer if the seller does not supply the specified goods as per the contract. A credit security bond serves as collateral for repaying a loan. A rental guarantee serves as collateral for rental agreement payments.

A confirmed payment order is an irrevocable obligation where the bank pays the beneficiary a set amount on a given date on the client’s behalf. A warranty bond serves as collateral ensuring ordered goods are delivered as agreed.