projects / Case Studies

Date: 22th April 2024

Title - Expanding Horizons: Tamil Nadu's Premier Business Park to Undergo Multi-Million Dollar Expansion and Innovation Drive

We are delighted to announce our collaboration with a premier land parcel company based in Tamil Nadu. This company operates a substantial business park catering to both B2B and B2C segments, which has become a vibrant hub for industry-specific commerce.

The business model is exceptional. The company has constructed over 1000 shops within the park, successfully selling 90% of these units to industry-related businesses. Approximately 50% of the purchasers are operators within the same industry, using the space to showcase their products. The remaining 50% are investors who have rented their spaces to similar industry tenants.

Currently, the park is undergoing an exciting expansion to include a multiplex and host both B2B and B2C international brands. In support of this growth, the company is planning a significant fundraising initiative aiming to secure around 20 million USD.

We have been appointed to oversee the structuring of the entire financial model, manage financial closure, create innovative financial vehicles, and prepare feasibility studies, information memorandums, financial models, and valuations. Additionally, we are tasked with appointing the necessary personnel to ensure the project's success.

This partnership underscores our commitment to facilitating sustainable and profitable growth, leveraging our expertise to support our client's ambitious expansion plans.

Date: 20th April 2024

Title - Enabling Strategic Growth and Global Partnerships for Auto Components Leaders

We are thrilled to announce our recent collaboration with a leading Auto Components Manufacturer, specializing in rubber mouldings, boasting an impressive annual turnover of Rs 500 crore. We successfully facilitated their participation in the Tamil Nadu Investor Meet, securing a Memorandum of Understanding (MOU) from the Chief Minister and assisting in obtaining government orders (GO).

In the initial phase, we aided in securing the Directorate of Town and Country Planning (DTCP) approval and are now actively working towards obtaining the Consent to Operate (CTO) approvals. Looking ahead, we are excited to assist the company in expanding their horizons to Malaysia, where we will facilitate meetings with key automotive companies to foster international partnerships.

Additionally, we are committed to supporting their future fundraising endeavors and navigating through the necessary approvals to ensure continued success.

Date: 18th April 2024

Title - Strategic Financial Advisory to Propel Certification-Oriented Leader Towards Expansion.

We are pleased to announce our new strategic advisory partnership with a leading provider of comprehensive certification-oriented services. Our client specializes in a broad range of certifications, including AS 9100, ISO 27001, ISO 22001, VDA 6.3, ISO 9001:2015, ISO 14001:2015, IATF 16949:2016, and ISO 45001:2018. They are committed to enhancing operational excellence through practices such as 5S, TPM, TQM, lean manufacturing, and Six Sigma, which streamline processes and foster continuous development. Additionally, they are involved in third-party inspections for manufacturing companies' production side.

Our role involves structuring their financials and balance sheets to support their expansion goals, either through an IPO or direct investment avenues. We will be providing comprehensive advisory services, navigating regulatory frameworks, and preparing detailed financial models and valuations. Additionally, our work will include the preparation of informative memorandums and identifying suitable funding opportunities to support their growth and enhance shareholder value. Less turnover, EBITA 40%.

This partnership underscores our commitment to supporting firms that prioritize quality, compliance, and continuous improvement in their operations.

Year - 2023

Location - Tamil Nadu

Topic - TamilNadu Global Investors Meet

Engaged in collaboration with five distinguished enterprises headquartered in Tamil Nadu, our innovative, creative, and strategically-oriented advisory firm is dedicated to pioneering solutions in unique domains such as securing funding, accessing government incentives, obtaining approvals, and streamlining operational processes.

Our commitment to these endeavors is underscored by our proactive approach in facilitating financial closures, amounting to a substantial Rs 3800 crore in investments for the benefit of the partnered companies. Additionally, we provide comprehensive support in enabling their participation in global investor meetings and guide them through the meticulous process of signing Memoranda of Understanding (MOUs) with the government.

In the realm of securing favorable land deals, we navigate the intricacies of negotiations with government bodies, ensuring a seamless process. Our proficiency extends to managing online applications for various approvals, including those from the Department of Town and Country Planning (DTCP), pollution control, and fire safety, culminating in the acquisition of official endorsements.

Currently, our strategic advisory firm is actively engaged with five companies, exemplifying our prowess in fostering their success by combining innovation, creativity, and strategic acumen in navigating the complex landscape of funding, incentives, approvals, and operational efficiency.

Type of Services - Professional & Liasoning Services

Detail Services - Analysis on obtaining sustainable government funding and permissions, creation of proposals, and application submission The process begins with guidance bureau approval, DTCP factory building approval, land conversion to industrial use approval, roads NOC, PWD NOC, pollution control NOC, grants from the ministry of industries approval, electric policy approval, electricity board approval, etc.

Status - Ongoing

Customer ID - CD151220221

Location - India

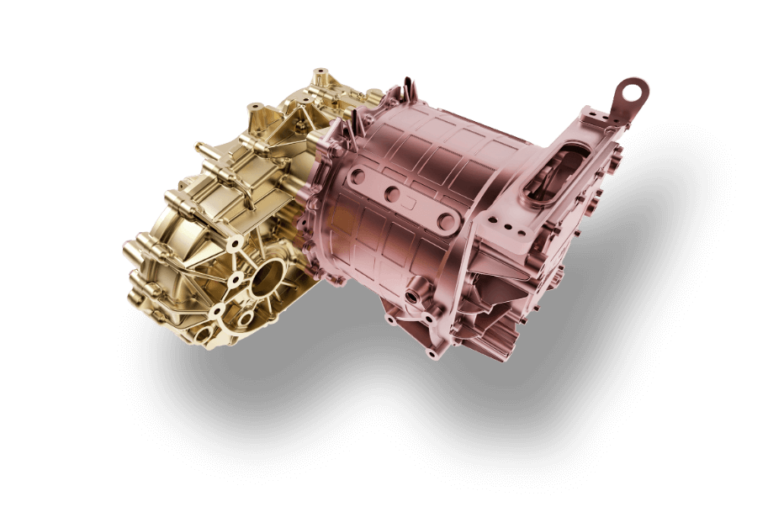

Type of Industry - EV motor manufacturing

Sales - It is Startup

EBITA - NA

Customer Requirement - Preparation, approvals and grants

Type of Services - Liasoning services

Detail Services - In order to resolve land clearance issues with the locals, it is necessary to inform them of the problem and its advantages, to inform them of the job prospects available, and to make arrangements for local municipal approvals.

Status - Ongoing

Customer ID - CD251220221

Location - Tamil Nadu, India

Type of Industry - Steel and defence equipment manufacturing

Sales - It is Startup

EBITA - NA

Customer Requirement - Above issues resolvement

Type of Services - Professional & Liasoning Services

Detail Services - Analysis on obtaining sustainable government funding and permissions, creation of proposals, and application submission The process begins with guidance bureau approval, DTCP factory building approval, land conversion to industrial use approval, roads NOC, PWD NOC, pollution control NOC, grants from the ministry of industries approval, electric policy approval, electricity board approval, etc.

Status - Ongoing

Customer ID - CD151220221

Location - India

Type of Industry - EV motor manufacturing

Sales - It is Startup

EBITA - NA

Customer Requirement - Preparation, approvals and grants

Year - 2023

Client - Manufacturing Company

Location - South India

Topic - Government Clearance

Problem - Local people near the factory were sending notices to various departments, creating continuous problems for the company. Due to numerous petitions, the respective departments were granting clearances slowly, even though the company complied with many requirements.

Approach - Meet the highest authority in the state, explain the situation, employment opportunities, revenue generation (including electricity, tax, GST, etc.), and industrial growth.

Strategy - Meet the local people, understand their concerns, and address them by talking smoothly and providing basic support. Visit the respective government departments to understand the issues, gaps in application submissions, scrutinize the stages, and explain the status of the first approach.

Solution: By implementing the above strategies and approaches, the company was able to obtain the necessary clearances within a week, which had been pending for 8 months and would have taken another 8 months to process.

Year - 2023

Client - Business owner and investor from South India, running a chain of luxury hotels in holiday Destinations in India and abroad.

Location - Tamil Nadu

Topic - Recovery of Investment

Problem - The client had invested a substantial amount in a particular project through their representative. Despite conducting due diligence and making the investment, there had been no response from the investee for almost five years, despite multiple attempts to reach them via direct and phone communication.

Approach - The first step was to conduct a comprehensive document inspection, reviewing the method of investment, correspondences, and other relevant information. Understanding the complete history of the investment was crucial to developing an effective recovery strategy. The steps taken to resolve the issue: Communication: We established communication with the investee through appropriate channels. Professional and assertive communication was maintained throughout the process. Negotiation: After opening lines of communication, we initiated negotiations with the investee. Our primary objective was to reach a mutually agreeable settlement. Mediation: We played a crucial role as a mediator, facilitating conversations between both parties. This approach allowed for a better understanding of each other's perspectives and concerns. Settlement: After productive negotiations, both parties reached a settlement that was fair and satisfactory. The settlement included the return of the entire invested amount to our client. Property Position: In addition to the monetary settlement, we also secured a property position for our client. This added value ensured a more comprehensive recovery of their investment. By combining a well-structured strategy with effective communication and negotiation skills, we successfully achieved the recovery of the client's investment in the Chennai project. Our commitment to resolving the issue and dedication to our client's interests were instrumental in bringing about this positive outcome. This case study demonstrates our ability to handle complex and challenging situations while maintaining a focus on delivering favorable results for our clients. Our experience in handling investment-related disputes and our expertise in mediation and negotiation contributed to the successful recovery of our client's substantial investment in the Chennai project. User steps taken to be included in the approach ChatGPT Apologies for the oversight. Here are the detailed steps taken in the approach to recover the investment: Document Inspection: Conducted a thorough review of all relevant documents related to the investment, including agreements, contracts, and correspondence between the client and the investee. This step provided us with crucial insights into the nature of the investment and the obligations of both parties. Understanding Investment Method: Gained a comprehensive understanding of how the investment was made, including the mode of payment, the terms of the investment, and any specific conditions or guarantees associated with it. This information helped in framing our recovery strategy. Identifying Communication Gaps: Analyzed the history of communication attempts made by the client with the investee. Identified any potential gaps or issues in communication that might have contributed to the lack of response from the investee. Legal Analysis: Assessed the legal aspects of the investment and evaluated any potential legal recourse available to the client in case the investee continued to be unresponsive. Prepared to leverage legal options, if necessary, to pressure the investee to address the issue. Strategic Communication Plan: Developed a well-structured communication plan to approach the investee. Crafted clear and concise messages that conveyed the seriousness of the matter and the client's willingness to resolve the issue amicably. Establishing Contact: Initiated contact with the investee through appropriate channels, ensuring professionalism and respect in all interactions. We used various means such as email, registered mail, and phone calls to ensure that the communication reached the investee effectively.

Strategy -Our approach was to help the client recover their investment by employing a strategic plan.

Solution: Through persistent efforts and effective communication, we engaged with the investee and conveyed the seriousness of the matter. Productive negotiations led to a fair settlement. The client also secured a valuable property position, enhancing the overall outcome.

Year - 2023

Client - Manufacturing Company

Location - Tamil Nadu,India

Topic - Streamlining Approvals and Maximizing Opportunities

Problem - The manufacturing company faced several challenges related to missing approvals, accessing government grants, and identifying external financial opportunities to enhance their business. These issues hindered their growth potential and exposed them to unnecessary regulatory risks.

Approach - We began by conducting a thorough assessment of the company's operations and identifying the key approvals required for their business. Simultaneously, we explored potential government subsidies and incentives that could be accessed through these approvals. Our approach involved initiating the process of obtaining the DTCP industrial approval, which was a crucial step for the company. We meticulously handled various tasks, including creating drawings, submitting documents online, obtaining attestation from local bodies, coordinating with government agencies such as PWD, Highway, Pollution Control Board, and Guidance Bureau, and facilitating inspections. Throughout the approval journey, we maintained close communication with all stakeholders involved and ensured that every requirement was met promptly. Our proactive approach and attention to detail were vital in navigating potential obstacles and expediting the process.

Strategy -Our goal was to improve the quality of the client's business operations by addressing these challenges. We devised a comprehensive strategy to streamline the approval process, secure government grants, and identify additional financial opportunities.

Solution: As a result of our efforts, the manufacturing company successfully obtained the DTCP industrial approval. This achievement provided them with numerous benefits, including: a) Regulatory Compliance: By obtaining the necessary approvals, the company now operates within the regulatory framework, eliminating the risk of future unnecessary notices from the government. This ensures a smoother and uninterrupted business operation. b) Government Grants: The approval process unveiled substantial grant opportunities from the government. By leveraging these grants, the company gained access to additional financial resources, enabling them to invest in growth initiatives and expand their operations. c) Energy Efficiency and Sustainability: As part of our comprehensive approach, we also identified energy-saving measures and carbon credit opportunities for the company. Implementing these suggestions helped the client reduce operational costs, enhance their environmental performance, and contribute to sustainable development. Overall, our strategic approach not only resolved the immediate challenges faced by the manufacturing company but also positioned them for long-term success. By streamlining approvals, securing government grants, and exploring new financial opportunities, we helped them maximize their business potential and achieve regulatory compliance, ensuring a prosperous future for their operations in Tamil Nadu.

Year - 2023

Client -Restaurant Chain

Location - Tamil Nadu,India

Topic - Financial Funding and Growth Strategy

Problem - In 2023,a restaurant chin based in Tamil Nadu was facing a critical issue with funding. They needed financial support to fuel their expansion plans and drive business growth..

Approach - The approach take to execute the strategy involved the following Steps

Crafting an attractive pick:

An engaging and visually appealing pitch was prepared to attract potential investors. The pitch highlighted the chain's financials, growth potential, and unique selling propositions.

Identifying and engaging investors:

A team was assembled to conduct in-depth research and identify potential investors.

Rigorous screening was done to select the most suitable individuals or entities. Multiple meetings were then arranged between the investors and the client.

Showcasing financials and growth models:

During the investor meetings, the financial projections, Valuations, and growth models were showcased. These models included plans for franchising the restaurant chain, manufacturing and distributing snacks and powers, as well as implementing a implementing a mini-hall model to ensure regular business.

Strategy -To address the funding problem, a comprehensive strategy was implemented. The strategy involved the following steps:

Identifying the financial gap:

A thorough analysis of the client's business was conducted to identify the specific financial gap that needed to addressed. This involved examining the company's financials and operations in detail

Assisting with financial projections and valuations:

Real-time Financial Projections and Assumptions were prepared to assist the client in presenting a clear picture of their Financial situation. Valuations were also conducted using methods such as Discounted Cash flow (DCF),Precedent transaction analysis, Total Addressable Market (TAM),Serviceable Addressable Market (SAM),and Comparables

Identifying Funding Requirements:

Based on the financial Analysis,the funding Requirements were Identified in Stages. This Approach Allowed For a Structured and Phased Approach to Securing the necessary capital.

Solution: Through the implementation of this strategy and approach ,the restaurent chain successfully attracted investors and secured the required funding .The investor meetings were fruitful, with the financials and growth models impressing the potential backers. As a result, the deal was concluded successfully, Providing the necessary capital for the client's expansion plans and ensuring the long-term growth and success of the restaurant chain.

By effectively addressing the funding challenge and implementing a well-rounded growth strategy, the restaurant chain in Tamil Nadu was able to overcome financial constraints and establish a path for sustained success in the highly competitive food industry.

Year - 2023

Client - 5 Different sectors - Automobile, Defence equipment, Alternator, Health care, Components

Location - Tamil Nadu

Topic - Driving Commitment and Facilitating Growth

Problem - Our clients faced the challenge of securing substantial investments and accessing government support to drive growth and innovation in their respective sectors. They needed strategic guidance and comprehensive assistance to overcome these hurdles and position themselves for success.

Strategy - SHS Advisory Group devised a comprehensive strategy to address the problem faced by our clients. Our strategy involved providing fundraising assistance, securing grants, and positioning our clients for industry recognition.

Approach - Fundraising Assistance: We offered strategic guidance to our clients, helping them showcase their potential and secure substantial investments of INR 50 Crore each. By leveraging our network and industry expertise, we connected them with potential investors and facilitated fruitful collaborations. Securing Grants: Our team diligently researched and identified governmental opportunities and grants relevant to our clients' industries. We navigated the complex landscape of grants and subsidies, leveraging our knowledge and connections to secure valuable financial support for our clients. Positioning for Industry Recognition: We actively worked towards positioning our clients as industry leaders. Through our extensive network and industry events, we facilitated their participation in a significant event organized by MSME Tamil Nadu. This event provided them with industry recognition, further enhancing their credibility and opening doors for future collaborations.

Conclusion - SHS Advisory Group's strategic approach successfully addressed the challenges faced by our clients. By providing fundraising assistance, securing grants, and positioning our clients for industry recognition, we enabled them to showcase their commitment and drive growth. Our clients' investments of INR 50 Crore each, secured grants, and participation in a prominent industry event validate the effectiveness of our approach. This case study demonstrates our ability to connect opportunities, empower businesses, and position our clients for remarkable success in their respective sectors.

Year - 2023

Client - Owner of large land parcel and a chairman of listed company

Location - Tamil Nadu

Topic - Safeguarding Land Investments from Fraudulent Practices: A Strategic Approach

Problem - Our client, a windmill investor in Tamil Nadu, found themselves confronted with serious land parcel issues. The primary concern was the discovery that a significant portion of their land had been duplicitously sold to them with fraudulent or double document registration. This left them grappling with the complex legal implications, and they sought our expertise at SHS Advisory Group to help resolve this predicament and future-proof their investment.

Strategy - Our strategy involved a two-pronged approach: resolving the existing fraudulent land acquisition issue and implementing protective measures to prevent future occurrences. We aimed to create a robust, proactive strategy that would not only address the immediate problem but also safeguard the client's investment in the long term.

Approach - We started by conducting a thorough audit of the client's land parcels, identifying those acquired through fraudulent means. We engaged legal experts to challenge these acquisitions, armed with the necessary documentation to support our client's claim. Concurrently, we advised on strategic divestment of these problematic parcels, which resulted in capital influx. To prevent future fraudulent acquisitions, we advised the client to invest in a rigorous due diligence process before any future land purchases. We also suggested the use of the capital influx to secure the boundaries of the remaining land parcels through clear demarcation and fencing to prevent future disputes. Furthermore, we proposed a strategy to optimize the productivity of the remaining legitimate land parcels. This included the plantation of low-maintenance, high-yield crops like neem and murunga, creating a consistent revenue stream.

Conclusion - Our comprehensive strategy allowed the client to effectively navigate the complex issue of fraudulent land acquisitions. We were successful in identifying and divesting the problematic land parcels, securing the remaining legitimate parcels, and laying the groundwork for a consistent revenue stream. This not only resolved the client's immediate issues but also provided a future-proof investment strategy. The resolution of this case underscores SHS Advisory Group's dedication to providing strategic, innovative, and tailored solutions to our clients' unique challenges. We remain committed to safeguarding our clients' interests and ensuring the longevity of their investments.

Year - 2022

Client - Chairman of a Medical Institution

Location - Tamil Nadu

Topic - Supermarket Chain Expansion and Service Launch

Problem - A client from South Tamil Nadu, operating several medical education institutions, approached SHS Advisory Group with a vision to establish a super chain supermarket in their vicinity. Their objective was to provide convenient and comprehensive retail services to the local community, with plans to expand the chain in the future. The client sought our expertise in developing a project report to guide them through the entire process.

Strategy - At SHS Advisory Group, we understand the importance of meticulous planning and strategic decision-making when it comes to business expansion. To address the client's requirements, we devised a comprehensive strategy that encompassed various aspects of supermarket operations and management.

Approach - Market Research: We conducted extensive market research to identify the specific needs and preferences of the local consumer base. This involved analyzing existing retail trends, competitor analysis, and customer behavior to determine the product mix, pricing strategies, and marketing initiatives. Funding and Financial Planning: We assisted the client in creating a stage-wise funding plan to ensure a smooth and sustainable launch of the supermarket. Our team meticulously estimated the required investment, considering factors such as store setup costs, inventory procurement, staff recruitment, and initial marketing expenses. Operational Setup: We provided detailed guidance on the operational setup of the supermarket, including staff requirements, salary structures, organizational hierarchy, and customer relationship management (CRM) systems. Our recommendations aimed to optimize efficiency and ensure excellent customer service. Marketing and Promotion: We developed a tailored marketing strategy that aligned with the client's goals and targeted the local demographic. This included suggestions for promotional schemes, budget allocation, expense forecasting, and income projections. We also advised on product placement strategies to maximize consumer engagement and convenience.

Conclusion - Our holistic approach and meticulous planning yielded a comprehensive solution for our client. The project report covered various aspects, including market research findings, funding requirements, operational setup, and marketing strategies. The client was delighted with SHS Advisory Group's approach, as it provided a clear roadmap for the successful launch and expansion of their supermarket chain.

Year - 2023

Client - Textile Mill owner

Location - Tamil Nadu

Topic - Solar Project Investment for Captive Consumption

Problem - the client had untapped potential for leveraging solar energy despite possessing land, having a high volume of business, and heavy electricity consumption.

Strategy - At SHS Advisory Group, we are dedicated to identifying opportunities and providing innovative solutions to businesses. Through our extensive research, we discovered a potential opportunity for a client in South Tamil Nadu to invest in a solar project for captive consumption.

Approach - Identifying the Gap: Through our research and analysis, we identified that the client had untapped potential for leveraging solar energy due to their possession of land, high power consumption, and substantial turnover. Communication and Education: We initiated communication with the client to educate them about the significant advantages of solar projects, including cost savings, sustainability, and potential tax benefits. We highlighted how a solar project could align with their business goals and enhance their energy efficiency. Financial Structuring: SHS Advisory Group assisted the client in structuring the financial aspects of the solar project. This involved exploring options for obtaining bank loans and equity investments to fund the project. Government Incentives: We provided guidance in navigating the complex landscape of government incentives for renewable energy projects. Our team prepared a comprehensive project report to showcase the viability and potential benefits of the solar investment. We also supported the client in liaising with government officials and securing relevant incentives.

Conclusion - This case study exemplifies SHS Advisory Group's expertise in identifying potential gaps and providing tailored solutions to businesses. By proactively reaching out to the client and presenting the benefits of a solar project, we were able to help them harness renewable energy to meet their power consumption needs and achieve long-term cost savings. If your business is seeking opportunities to leverage renewable energy solutions, SHS Advisory Group is here to assist you. Contact us today to explore the potential benefits of sustainable energy investments.

Year - 2023

Client - Sub-Assembly Manufacturer

Location - Tamil Nadu

Topic - Locating a Key Vendor for a Sub Assembly Manufacturer

Problem - Our client, a sub-assembly manufacturer in Tamil Nadu, faced a persistent challenge. They had been trying to locate a specific vendor in China for several years to no avail. This vendor was crucial for the client to acquire particular parts, which were essential for their manufacturing process.

Strategy - Our team decided to deploy our extensive network and advanced research capabilities to solve the problem at hand. We knew that a well-structured, targeted search would be the most effective way to locate the desired vendor in the vast Chinese market.

Approach - We initiated a comprehensive search, using a variety of resources and techniques to track down the elusive vendor's information. This involved leveraging our contacts within the industry, exploring databases, and diving into digital resources. Simultaneously, we prepared the groundwork to facilitate communication between the client and the vendor once the latter was located.

Solution: After diligent effort, we were successful in finding the vendor and establishing contact. We then bridged the communication gap between our client and the vendor, making sure to foster a smooth dialogue between both parties. The result was a robust and mutually beneficial business relationship.

Through our team's determined and expert assistance, the client was finally able to connect with the desired vendor. Our comprehensive approach proved instrumental in overcoming the challenge and achieving a successful outcome that will positively impact our client's business for years to come

Year - 2023

Client - Auto Spare Parts Manufacturer

Location - Uttarkand

Topic - Resolving Contractor Payment Disputes

Problem - Our client, a leading manufacturer of auto spare parts based in Uttarkand, found themselves embroiled in a dispute with a contractor. The issue at hand was a contention over a payment that the client firmly believed had been made, whereas the contractor claimed non-receipt of the said payment. This dispute put the professional relationship between the two parties at risk, and the associated stress was proving to be a distraction from the client's primary business activities.

Strategy - We recognized that clear, detailed evidence and open communication would be key to resolving this dispute. Our strategy was to validate the client's claim of payment, gather supporting evidence, and engage the contractor in a transparent, productive discussion.

Approach - We started by diligently examining the client's financial records to verify the payment status. We gathered all necessary documents, including bank statements, transfer receipts, and any relevant correspondence. Once we had a strong body of evidence supporting the client's claim, we initiated a dialogue with the contractor. Our objective was to foster understanding and seek a mutually agreeable resolution, while ensuring the work carried out by the contractor was completed as per the contract.

Solution: Armed with the evidence and a commitment to open communication, we successfully resolved the payment dispute. The evidence confirmed the client's assertion of payment, safeguarding their interests, and the contractor acknowledged receipt of payment. The contractor also completed their assigned work according to the agreed-upon terms. This resolution not only resolved the immediate dispute but also allowed for the maintenance of a positive professional relationship between the client and the contractor. In the end, our strategic approach and dedicated problem-solving skills helped the client successfully navigate this challenge