The process that involves selling and buying of an entity’s assets that comprise of more than the half of the target entity’s consolidated assets is known as Asset Restructuring.

WHO IS THIS FOR?

Companies that became a non-performing asset in the bank

Companies facing a financial crisis or issues looking for asset reconstruction funding.

HOW DO I SIGN UP?

Your business/financial analysis report, financial model, valuation, pitch book, or Information Memorandum will be compiled

NDA and mandate are signed on agreed terms after target companies/investors are reached out using a tailor made methodology.

KEY BENEFITS

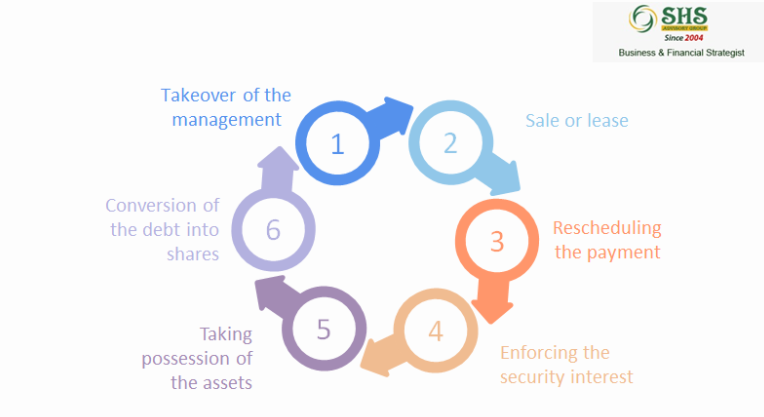

The ARC can take over only secured debts that has been classified as non-performing assets (NPA). In case debentures/bonds remain unpaid, the beneficiary of the securities is required to give a notice of 90 days before it qualifies to be taken over.

FACTS ON ASSET RESTUCTURE FUNDING

An asset reconstruction company is a special type of financial institution that buys the debtors of the bank at a mutually agreed value and attempts to recover the debts or associated securities by itself.

The ARCs take over a portion of the debts of the bank that qualify to be recognized as Non-Performing Assets. Asset reconstruction companies are in the business of buying bad loans from banks. For instance, if a bank lends money to a person or company, they expect to receive periodic payments of principal and interest. If they can recover the money, they make a profit, if not they lose the money.