management buyout

A management buyout (MBO) is a transaction where a company’s management team purchases the assets and operations of the business they manage.

In most cases, the management team takes full control and ownership, using their expertise to grow the company and drive it forward.

In most cases, the management team takes full control and ownership, using their expertise to grow the company and drive it forward.

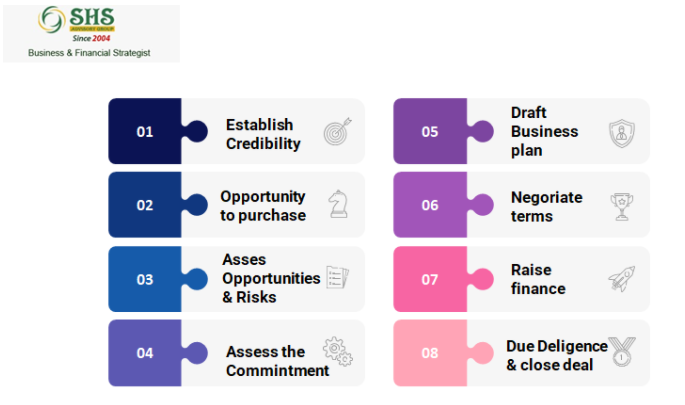

OUR PROCESS

- Establish Credibility with owners

- Opportunity to purchase the business you work for

- Assess the opportunities & Risks

- Assess the commitment required (Money, Managers & Time)

- Write a Business plan

- Negotiate Terms of the Sale

- Raise Finance

- Complete Due Diligence

- Close the deal (becoming owners)

Documents required

- Share Purchase agreement

- Disclosure Agreement

- Articles of association

- Investor agreement

- Security documents

- Inter-creditor deed

- Cross guarantees

- Resolution